Today in class we had a short discussion on which is the economic and political power of Corporations and Transnational Companies in the Global Political Economy as compared with the power that have states and governments. Undoubtedly, the scope and array of political activities of companies is huge and their economic activities are even more diverse.

More so, the power of these corporations to shape culture, politics and media is widely studied and written about in books, journals and documentaries. What is usually not mentioned is that these huge and powerful companies have acquired political power by the use of their profits for the sake of protecting their interests. These interest and the means used are subject of ethical judgement.s

Generally, the political power to which we usually identify this corporations is that of lobbying. However, many other ways of achieving global economic and political power are open for corporations by allying with ruling governments, offering loans and investment for countries and/or new cities; but also by the enforcement of specific news agendas and in the Media to inform citizens.

It is of particular interest for me the ethics of the political and economic power that a company has. The pursuit of profit is the goal of a company by the provision of services to its consumers. It is profit which fuels a company to continue growing and providing services. However, this activity of pursuing profit is subject for ethical judgements that historically have been judged by/from immoral philosophical backgrounds. (For further information on what I consider to be Morality or Ethics please visit: http://aynrandlexicon.com/lexicon/morality.html)

The pursuit of profit is a moral action when undertaken in consistency with the respect of individual rights. As such, a company should and can influence politicians by lobbying when it considers it necessary for them to increase their profits. The lobbying that is ethical is that which doesn’t creates privileges but that which eliminates regulations on competition that was previously benefiting special interest groups.

Historically, the role that Corporations and Transnational Companies have had should be analysed in context when judged about its morality or immorality. Thousands of pages of research that demonstrate how corporations have used its political power to achieve special privileges can be found everywhere. The immorality of the actions of many corporate managers has been demonstrated and data on how they have violated human rights can easily be found in newspapers. But this is not an absolute; just because some (or most) of the companies have violated and abused of their economic and political power it doesn’t make of them to be intrinsically evil or corrupt.

Corporations are not humans. However, corporations are managed by humans whom depending on their philosophies of life can respect or violate individual rights and disobey the rule of law. It are only those companies which act ethically which at the end of the day will profit the most and benefit the rest of society in a positive sum game. Those companies and their managers who are willing to violate rights and act unethically have brought the Global Political Economy into zero sum game results in which only one side of the exchange has benefited.

And here, once again, the enlightment of Ayn Rand comes to play particular interest when identifying which is the difference between economic power and political power. As well, as what is ethically correct for a company to do or not to do.

Rand wrote that,

What is economic power? It is the power to produce and to trade what one has produced. In a free economy, where no man or group of men can use physical coercion against anyone, economic power can be achieved only by voluntary means: by the voluntary choice and agreement of all those who participate in the process of production and trade. In a free market, all prices, wages, and profits are determined—not by the arbitrary whim of the rich or of the poor, not by anyone’s “greed” or by anyone’s need—but by the law of supply and demand. The mechanism of a free market reflects and sums up all the economic choices and decisions made by all the participants. Men trade their goods or services by mutual consent to mutual advantage, according to their own independent, uncoerced judgment. A man can grow rich only if he is able to offer better values—better products or services, at a lower price—than others are able to offer.

Wealth, in a free market, is achieved by a free, general, “democratic” vote—by the sales and the purchases of every individual who takes part in the economic life of the country. Whenever you buy one product rather than another, you are voting for the success of some manufacturer. And, in this type of voting, every man votes only on those matters which he is qualified to judge: on his own preferences, interests, and needs. No one has the power to decide for others or to substitute hisjudgment for theirs; no one has the power to appoint himself “the voice of the public” and to leave the public voiceless and disfranchised.

Now let me define the difference between economic power and political power: economic power is exercised by means of a positive, by offering men a reward, an incentive, a payment, a value; political power is exercised by means of a negative, by the threat of punishment, injury, imprisonment, destruction. The businessman’s tool is values; the bureaucrat’s tool is fear.

And by this she meant that economic power is always ethical because it pursuits a reward for men everywhere and anytime (in the entire process of designing, production, transportation and distribution of products and services). And as such that the political power of a company appears when the businessman becomes a bureaucrat or lobbyist that uses the power of government to achieve privileges for himself and his company.

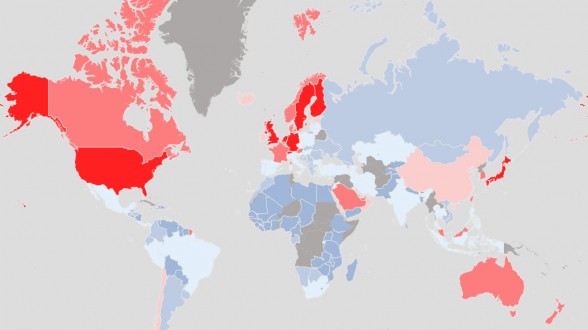

This discussion comes from observing the following table which presents the GDP-PPP of the Top 100 Economies in the World (2009) which was prepared by the World Bank. Particularly relevant from this table is the fact that among the top 100 economies the authors included also the largest companies in the world in base of their Revenues-PPP (2009). In position #32 appears Royal Dutch Shell as the largest company of the list with revenues of 458 billion dollars and it is followed by ExxonMobil in position 35 with 426 billion dollars. These two companies had Revenues-PPP in 2009 which surpassed the size of the GDP-PPP of countries like Venezuela (#48), Greece (#52) and Switzerland (#53).

Even though is not commonly done; I have always studied Global Political Economy by remembering clearly what is ethical human behavior and what is not. Starting from this point then I try to understand what is or can be the effects of a government’s or corporation’s decisions in real world cases. Unfortunately, the ruling ethical code among Academics today considers it to be evil to pursue profit, self-interest, individualism and collaboration in order to create positive sum games in global exchange.

Indeed, historical examples are not the best reference for illustrating how we can benefit from an Objectivist ethics perspective when understanding the role of Companies in Global Economy. However, it is this lack of many examples which should make it easier for us to identify how a Businessman success depends on “his intelligence, his knowledge, his productive ability, his economic judgment—and on the voluntary agreement of all those he deals with: his customers, his suppliers, his employees, his creditors or investors. A bureaucrat’s success depends on his political pull.” (Rand, The Ayn Rand Letter, III, 26, 5. 1971-76).

Now, it is time for me to continue reading history and seeking for those few exemplary examples of ethical businessmen who have given us the best products and services in positive sum games for the entire world.

51.339680

12.371300