I always keep track of the images from space taken by NASA. They usually have impressive “natural hazards” photographed with the highest technology available. However, sometimes the natural hazards to humanity are not caused by the natural cycles of Earth. In those cases, it is humans who have created hazards for themselves and people die. Now, why would we create things that harm us so much? Why would we support and contribute to such terrible things? A good explanation is the one given by economists with the complex and difficult term negative externalities.

A negative externality is a spillover of an economic transaction that negatively impacts a party that is not directly involved in the transaction. The first party bears no costs for their impact on society while the second party receives no benefits from being impacted. This occurs when marginal social cost is greater than marginal private cost (MSC > MPC).

The case of pollution in China elucidates very well how the market-driven approach to correcting externalities by “internalizing” third party costs and benefits fails to work in a globalized economy. For example, by requiring a polluter to repair any damage caused. But, in many cases internalizing costs or benefits is not feasible, especially if the true monetary values cannot be determined. In fact, our technological gadgets and thousands of products imported from China are the cause of the hazardous health conditions in that country. We as consumers are part of this chain by buying the products. How can we do something?

I would suggest that the best way to participate in a positive way is to continue creating awareness of the failure of the government of China to protect the lives of the Chinese people. It is at the end of the day the responsibility of that government to protect the life and property of its citizens, not ours. We as consumers can only morally sanction them and stop consuming their products whenever possible.

This is a good (and very unfortunate) example of how globalization without an objective code of values becomes a zero sum game. I share with you the information regarding how dangerous has become the air in the surroundings of Beijing and Tianjin,

—-

Residents of Beijing and many other cities in China were warned to stay inside in mid-January 2013 as the nation faced one of the worst periods of air quality in recent history. The Chinese government ordered factories to scale back emissions, while hospitals saw spikes of more than 20 to 30 percent in patients complaining of respiratory issues, according to news reports.

The Moderate Resolution Imaging Spectroradiometer (MODIS) on NASA’s Terra satellite acquired these natural-color images of northeastern China on January 14 (top) and January 3, 2013. The top image shows extensive haze, low clouds, and fog over the region. The brightest areas tend to be clouds or fog, which have a tinge of gray or yellow from the air pollution. Other cloud-free areas have a pall of gray and brown smog that mostly blots out the cities below. In areas where the ground is visible, some of the landscape is covered with lingering snow from storms in recent weeks. (Snow is more prominent in the January 3 image.)

At the time that the January 14 image was taken by satellite, ground-based sensors at the U.S. Embassy in Beijingreported PM2.5 measurements of 291 micrograms per cubic meter of air. Fine, airborne particulate matter (PM) that is smaller than 2.5 microns (about one thirtieth the width of a human hair) is considered dangerous because it is small enough to enter the passages of the human lungs. Most PM2.5 aerosol particles come from the burning of fossil fuels and biomass (wood fires and agricultural burning). The World Health Organization considers PM2.5to be safe when it is below 25.

Also at the time of the image, the air quality index (AQI) in Beijing was 341. An AQI above 300 is considered hazardous to all humans, not just those with heart or lung ailments. AQI below 50 is considered good. On January 12, the peak of the current air crisis, AQI was 775 the U.S Embassy Beijing Air Quality Monitor—off the U.S. Environmental Protection Agency scale—and PM2.5 was 886 micrograms per cubic meter.

-

Resources

- Air Pollution in China: Real-time Air Quality Index Visual Map. Accessed January 14, 2013.

- China Air Daily. Accessed January 14, 2013.

- U.S Embassy Beijing Air Quality Monitor. Accessed January 14, 2013.

-

References

- Associated Press, via Yahoo News (2013, January 14) Beijing warns residents after off-the-charts smog . Accessed January 14, 2013.

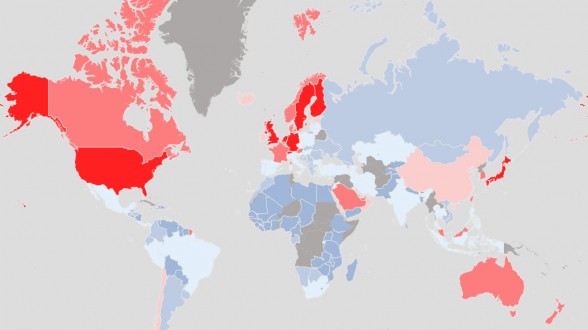

- NASA (2010, September 22) New Map Offers a Global View of Health-Sapping Air Pollution.Accessed January 14, 2013.

- NASA Earth Observatory (2012, March 23) Satellites Map Fine Aerosol Pollution Over China.

- The New York Times (2013, January 14) China allows media to report alarming air pollution crisis. Accessed January 14, 2013.

- Yahoo News (2013, January 14) China’s air pollution problem slideshow. Accessed January 14, 2013.

NASA image courtesy Jeff Schmaltz, LANCE MODIS Rapid Response. Caption by Mike Carlowicz.

Related articles

- MILLOY: China’s bad air puts the lie to EPA scare tactics (washingtontimes.com)

- Beijing’s air pollution as seen from space (blogs.scientificamerican.com)